All Categories

Featured

Table of Contents

This is just suggested in the event where the survivor benefit is really essential to the plan owner. The added expense of insurance coverage for the boosted coverage will lower the cash worth, hence not optimal under boundless banking where cash value dictates just how much one can obtain (Policy loans). It is necessary to keep in mind that the accessibility of reward alternatives might vary depending on the insurer and the details policy

Although there are great advantages for limitless banking, there are some things that you ought to think about before obtaining right into unlimited banking. There are also some cons to limitless financial and it might not be suitable for a person that is trying to find budget-friendly term life insurance policy, or if somebody is checking out buying life insurance policy only to secure their family members in the occasion of their fatality.

It is necessary to recognize both the benefits and restrictions of this economic method prior to deciding if it's appropriate for you. Complexity: Boundless banking can be complex, and it is necessary to recognize the details of just how a whole life insurance policy policy works and how policy car loans are structured. It is essential to properly set-up the life insurance policy policy to maximize limitless financial to its complete capacity.

What is the minimum commitment for Privatized Banking System?

This can be particularly problematic for individuals that rely upon the survivor benefit to attend to their loved ones. Overall, infinite banking can be a useful financial method for those that understand the information of how it works and agree to accept the costs and constraints connected with this investment.

Choose the "riches" choice instead of the "estate" choice. Most firms have 2 different sorts of Whole Life strategies. Select the one with higher money values previously on. Over the program of numerous years, you add a significant amount of money to the policy to develop up the cash worth.

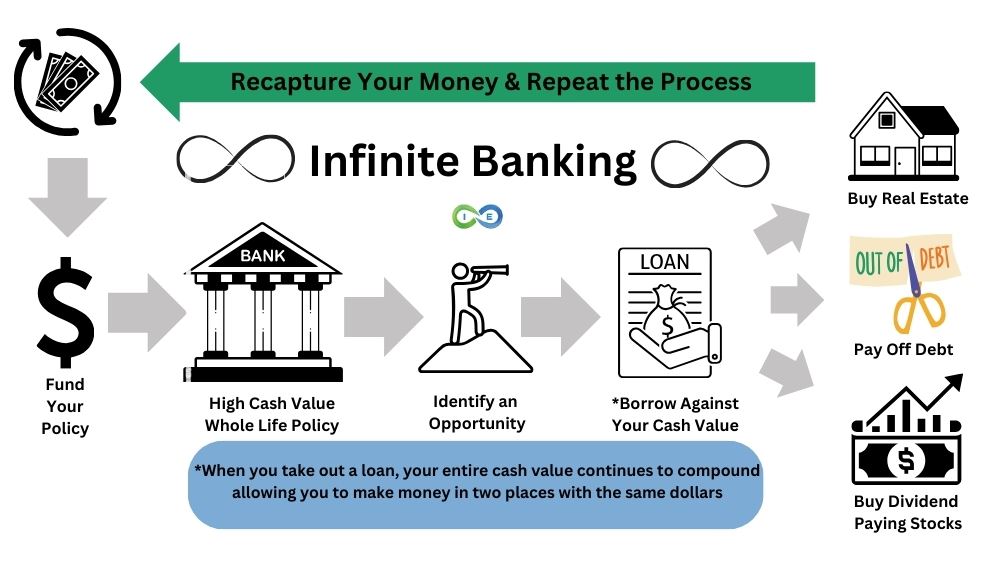

You're essentially lending money to on your own, and you pay back the financing with time, often with passion. As you pay back the funding, the cash money worth of the policy is restored, enabling you to borrow versus it again in the future. Upon fatality, the fatality benefit is decreased by any type of outstanding car loans, however any continuing to be survivor benefit is paid tax-free to the recipients.

What is the best way to integrate Policy Loans into my retirement strategy?

Time Horizon Danger: If the insurance policy holder determines to terminate the policy early, the money surrender worths may be considerably lower than later years of the plan. It is a good idea that when discovering this plan that has a mid to lengthy term time horizon. Taxes: The insurance holder may sustain tax consequences on the lendings, rewards, and survivor benefit settlements got from the plan.

Intricacy: Infinite banking can be intricate, and it is essential to recognize the information of the policy and the cash build-up part before making any type of financial investment decisions. Infinite Banking in Canada is a reputable monetary strategy, not a fraud - Policy loan strategy. Infinite Banking is a principle that was created by Nelson Nash in the USA, and it has given that been adjusted and carried out by monetary specialists in Canada and other countries

Self-financing With Life Insurance

Plan loans or withdrawals that do not exceed the modified cost basis of the plan are taken into consideration to be tax-free. If policy lendings or withdrawals exceed the modified price basis, the excess amount might be subject to taxes. It is essential to keep in mind that the tax obligation advantages of Infinite Banking may be subject to change based upon adjustments to tax legislations and policies in Canada.

The threats of Infinite Financial include the capacity for policy financings to reduce the fatality benefit of the policy and the opportunity that the plan might not carry out as anticipated. Infinite Banking might not be the most effective strategy for everybody. It is necessary to carefully consider the expenses and potential returns of joining an Infinite Banking program, as well as to extensively research and understand the affiliated threats.

Infinite Banking is different from traditional banking because it permits the insurance policy holder to be their very own source of funding, as opposed to counting on conventional financial institutions or loan providers. The policyholder can access the money worth of the plan and utilize it to finance purchases or financial investments, without needing to go via a standard loan provider.

How do I track my growth with Tax-free Income With Infinite Banking?

When the majority of people require a lending, they make an application for a line of credit score with a traditional financial institution and pay that car loan back, over time, with rate of interest. Yet what happens if you could take a lending from yourself? What happens if you could stay clear of the large banks completely, be your very own financial institution, and supply yourself with your very own line of credit report? For physicians and various other high-income income earners, this is possible to do with boundless banking.

Below's a monetary expert's testimonial of unlimited financial and all the pros and cons involved. Infinite financial is a personal financial strategy established by R. Nelson Nash. In his publication Becoming Your Own Lender, Nash explains just how you can utilize an irreversible life insurance policy policy that builds money value and pays rewards therefore releasing yourself from needing to borrow cash from lending institutions and pay back high-interest car loans.

And while not everyone gets on board with the idea, it has tested hundreds of countless individuals to reassess exactly how they financial institution and just how they take car loans. In between 2000 and 2008, Nash released 6 editions of the book. To this day, economic consultants ponder, technique, and discuss the idea of infinite financial.

Can I use Financial Independence Through Infinite Banking for my business finances?

The basis of the unlimited financial idea begins with irreversible life insurance - Life insurance loans. Infinite financial is not feasible with a term life insurance policy; you must have a long-term cash money value life insurance plan.

But with a dividend-paying life insurance plan, you can grow your cash money worth even quicker. One point that makes entire life insurance policy one-of-a-kind is gaining much more cash through dividends. Expect you have an irreversible life insurance policy plan with a shared insurer. In that instance, you will certainly be qualified to obtain component of the business's revenues much like how shareholders in the firm get dividends.

Latest Posts

Self Banking Whole Life Insurance

Allan Roth Bank On Yourself

Infinite Wealth And Income Strategy